-

Health Catalyst Reports Third Quarter 2024 Results

ソース: Nasdaq GlobeNewswire / 06 11 2024 16:03:00 America/New_York

SALT LAKE CITY, Nov. 06, 2024 (GLOBE NEWSWIRE) -- Health Catalyst, Inc. (“Health Catalyst,” Nasdaq: HCAT), a leading provider of data and analytics technology and services to healthcare organizations, today reported financial results for the quarter ended September 30, 2024.

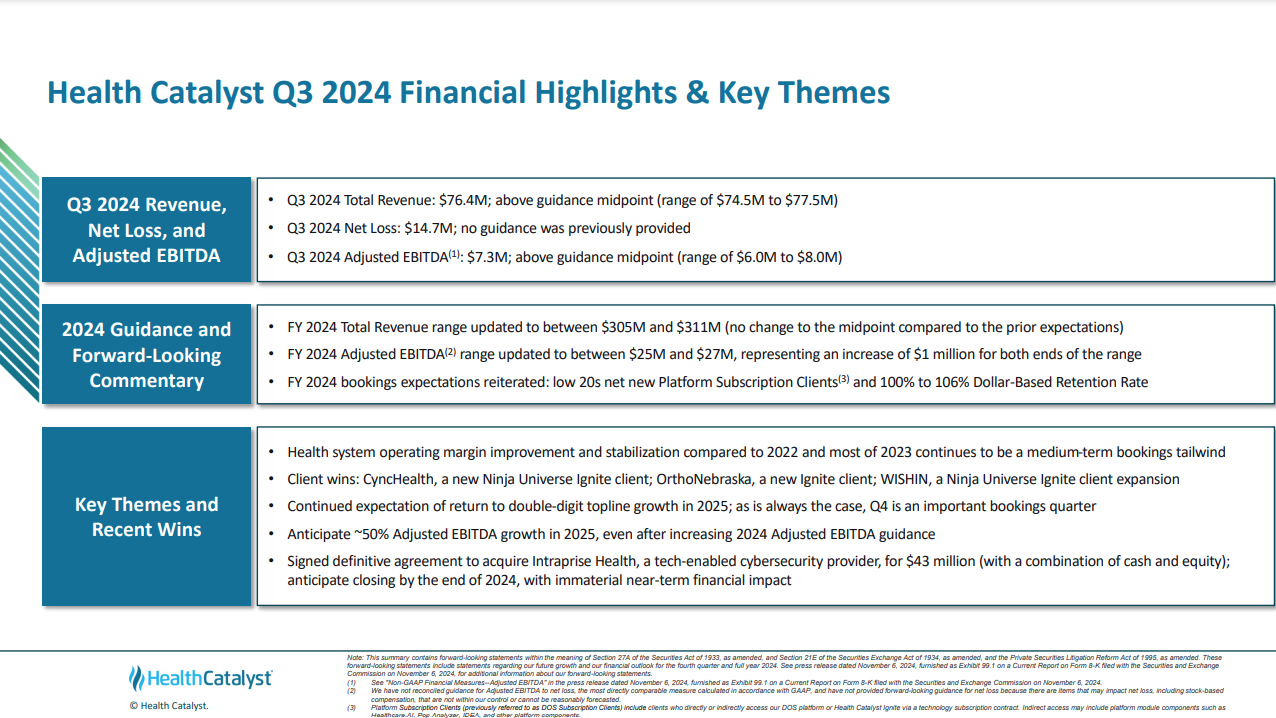

“For the third quarter of 2024, I am pleased with our strong financial results, including total revenue of $76.4 million and Adjusted EBITDA of $7.3 million, with these results exceeding the mid-point of our quarterly guidance on each metric. This financial performance continues to demonstrate our ability to scale as we remain focused on driving profitable growth. We are encouraged with our bookings results through Q3 2024 and we are excited to continue this momentum in Q4,” said Dan Burton, CEO of Health Catalyst. “Additionally, we are happy to be in a position to raise our Adjusted EBITDA guidance by $1 million for 2024. This is a testament to our commitment to financial discipline, operating leverage, and profitable growth.”

Financial Highlights for the Three Months Ended September 30, 2024

Key Financial Metrics

Three Months Ended September 30, Year over Year

Change2024 2023 GAAP Financial Measures: (in thousands, except percentages, unaudited) Total revenue $ 76,353 $ 73,773 3% Gross profit $ 27,758 $ 25,339 10% Gross margin 36 % 34 % Net loss $ (14,726 ) $ (22,032 ) 33% Non-GAAP Financial Measures:(1) Adjusted Gross Profit $ 36,289 $ 34,572 5% Adjusted Gross Margin 48 % 47 % Adjusted EBITDA $ 7,295 $ 1,992 266% ________________________

(1) These measures are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). See the accompanying "Non-GAAP Financial Measures" section below for more information about these financial measures, including the limitations of such measures, and for a reconciliation of each measure to the most directly comparable measure calculated in accordance with GAAP.

Financial Outlook

Health Catalyst provides forward-looking guidance on total revenue, a GAAP measure, and Adjusted EBITDA, a non-GAAP measure.

For the fourth quarter of 2024, we expect:

- Total revenue between $78.0 million and $84.0 million, and

- Adjusted EBITDA between $6.8 million and $8.8 million

For the full year of 2024, we expect:

- Total revenue between $305.0 million and $311.0 million, and

- Adjusted EBITDA between $25.0 million and $27.0 million

We have not provided forward-looking guidance for net loss, the most directly comparable GAAP measure to Adjusted EBITDA, and therefore have not reconciled guidance for Adjusted EBITDA to net loss, because there are items that may impact net loss, including stock-based compensation, that are not within our control or cannot be reasonably forecasted.

Quarterly Conference Call Details

We will host a conference call to review the results today, Wednesday, November 6, 2024, at 4:30 p.m. E.T. The conference call can be accessed by dialing (800) 343-5172 for U.S. participants, or (203) 518-9856 for international participants, and referencing conference ID “HCATQ324.” A live audio webcast will be available online at https://ir.healthcatalyst.com/. A replay of the call will be available via webcast for on-demand listening shortly after the completion of the call, at the same web link, and will remain available for approximately 90 days.

About Health Catalyst

Health Catalyst is a leading provider of data and analytics technology and services to healthcare organizations and is committed to being the catalyst for massive, measurable, data-informed healthcare improvement. Its clients leverage the cloud-based data platform—powered by data from more than 100 million patient records and encompassing trillions of facts—as well as its analytics software and professional services expertise to make data-informed decisions and realize measurable clinical, financial, and operational improvements. Health Catalyst envisions a future in which all healthcare decisions are data informed.

Available Information

Our investors and others should note that we announce material information to the public about our company, products and services, and other matters related to our company through a variety of means, including our website (https://www.healthcatalyst.com/), our investor relations website (https://ir.healthcatalyst.com/), press releases, SEC filings, public conference calls, and social media, including our and our CEO's social media accounts, in order to achieve broad, non-exclusionary distribution of information to the public and to comply with our disclosure obligations under Regulation FD.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements include statements regarding our future growth and our financial outlook for the fourth quarter and full year 2024. Forward-looking statements are subject to risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance.

Important risks and uncertainties that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) changes in laws and regulations applicable to our business model; (ii) changes in market or industry conditions, regulatory environment, and receptivity to our technology and services; (iii) results of litigation or a security incident; (iv) the loss of one or more key clients or partners; (v) the impact of the challenging macroeconomic environment (including high inflationary and/or high interest rate environments) on our business and results of operations; and (vi) changes to our abilities to recruit and retain qualified team members. For a detailed discussion of the risk factors that could affect our actual results, please refer to the risk factors identified in our SEC reports, including, but not limited to the Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2024 expected to be filed with the SEC on or about November 6, 2024 and the Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 22, 2024. All information provided in this release and in the attachments is as of the date hereof, and we undertake no duty to update or revise this information unless required by law.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share data, unaudited)As of

September 30,As of

December 31,2024 2023 (unaudited) Assets Current assets: Cash and cash equivalents $ 328,327 $ 106,276 Short-term investments 58,929 211,452 Accounts receivable, net 51,648 60,290 Prepaid expenses and other assets 18,510 15,379 Total current assets 457,414 393,397 Property and equipment, net 27,908 25,712 Intangible assets, net 76,463 73,384 Operating lease right-of-use assets 11,222 13,927 Goodwill 234,387 190,652 Other assets 5,656 4,742 Total assets $ 813,050 $ 701,814 Liabilities and stockholders’ equity Current liabilities: Accounts payable $ 14,278 $ 6,641 Accrued liabilities 23,548 23,282 Deferred revenue 52,202 55,753 Operating lease liabilities 3,329 3,358 Current portion of long-term debt 230,423 — Total current liabilities 323,780 89,034 Long-term debt, net of current portion 114,611 228,034 Deferred revenue, net of current portion 258 77 Operating lease liabilities, net of current portion 15,969 17,676 Other liabilities 3,395 74 Total liabilities 458,013 334,895 Stockholders’ equity: Preferred stock, $0.001 par value per share; 25,000,000 shares authorized and no shares issued and outstanding as of September 30, 2024 and December 31, 2023 — — Common stock, $0.001 par value per share, and additional paid-in capital; 500,000,000 shares authorized as of September 30, 2024 and December 31, 2023; 60,847,658 and 58,295,491 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively 1,521,146 1,484,056 Accumulated deficit (1,165,999 ) (1,117,170 ) Accumulated other comprehensive income (loss) (110 ) 33 Total stockholders’ equity 355,037 366,919 Total liabilities and stockholders’ equity $ 813,050 $ 701,814 Condensed Consolidated Statements of Operations

(in thousands, except per share data, unaudited)Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 (in thousands) (in thousands) Revenue: Technology $ 48,653 $ 45,973 $ 143,254 $ 140,483 Professional services 27,700 27,800 83,724 80,371 Total revenue 76,353 73,773 226,978 220,854 Cost of revenue, excluding depreciation and amortization: Technology(1)(2)(3) 17,609 15,169 48,991 45,755 Professional services(1)(2)(3) 24,704 26,618 71,899 73,774 Total cost of revenue, excluding depreciation and amortization 42,313 41,787 120,890 119,529 Operating expenses: Sales and marketing(1)(2)(3) 11,342 15,084 43,145 50,050 Research and development(1)(2)(3) 14,193 17,667 42,948 52,339 General and administrative(1)(2)(3)(4)(5) 12,209 13,625 41,136 61,129 Depreciation and amortization 9,983 10,190 31,165 31,919 Total operating expenses 47,727 56,566 158,394 195,437 Loss from operations (13,687 ) (24,580 ) (52,306 ) (94,112 ) Interest and other income (expense), net (1,514 ) 2,607 3,185 6,490 Loss before income taxes (15,201 ) (21,973 ) (49,121 ) (87,622 ) Income tax provision (benefit) (475 ) 59 (292 ) 213 Net loss $ (14,726 ) $ (22,032 ) $ (48,829 ) $ (87,835 ) Net loss per share, basic and diluted $ (0.24 ) $ (0.39 ) $ (0.82 ) $ (1.57 ) Weighted-average shares outstanding used in calculating net loss per share, basic and diluted 60,441 56,711 59,449 56,062 _______________

(1) Includes stock-based compensation expense as follows:Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Stock-Based Compensation Expense: (in thousands) (in thousands) Cost of revenue, excluding depreciation and amortization: Technology $ 450 $ 497 $ 1,206 $ 1,408 Professional services 1,601 1,927 4,282 5,682 Sales and marketing 2,555 5,149 8,997 16,049 Research and development 1,871 2,927 5,391 8,677 General and administrative 3,035 3,732 9,440 10,929 Total $ 9,512 $ 14,232 $ 29,316 $ 42,745 (2) Includes acquisition-related costs (benefit), net, as follows:

Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Acquisition-related costs (benefit), net: (in thousands) (in thousands) Cost of revenue, excluding depreciation and amortization: Technology $ 77 $ 66 $ 246 $ 208 Professional services 121 96 330 298 Sales and marketing 151 102 738 304 Research and development 183 198 612 587 General and administrative 955 1,664 3,805 1,705 Total $ 1,487 $ 2,126 $ 5,731 $ 3,102 (3) Includes restructuring costs as follows:

Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Restructuring costs: (in thousands) (in thousands) Cost of revenue, excluding depreciation and amortization: Technology $ — $ — $ 79 $ 12 Professional services — — 181 434 Sales and marketing — — 449 1,205 Research and development — — 443 286 General and administrative — — 936 118 Total $ — $ — $ 2,088 $ 2,055 (4) Includes litigation costs as follows:

Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Litigation costs: (in thousands) (in thousands) Cost of revenue, excluding depreciation and amortization: General and administrative $ — $ 24 $ — $ 21,279 Total $ — $ 24 $ — $ 21,279 (5) Includes non-recurring lease-related charges as follows:

Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Non-recurring lease-related charges: (in thousands) (in thousands) General and administrative $ — $ — $ 2,200 $ 2,681 Total $ — $ — $ 2,200 $ 2,681 Condensed Consolidated Statements of Cash Flows

(in thousands, unaudited)Nine Months Ended

September 30,2024 2023 Cash flows from operating activities Net loss $ (48,829 ) $ (87,835 ) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Stock-based compensation expense 29,316 42,745 Depreciation and amortization 31,165 31,919 Impairment of long-lived assets 2,200 2,681 Non-cash operating lease expense 1,981 2,272 Amortization of debt discount, issuance costs, and deferred financing costs 2,078 1,132 Investment discount and premium accretion (3,899 ) (6,816 ) Provision for expected credit losses 3,433 1,626 Deferred tax provision (benefit) (517 ) 6 Change in fair value of contingent consideration liabilities (1,642 ) — Other 87 101 Change in operating assets and liabilities: Accounts receivable, net 6,304 259 Prepaid expenses and other assets (617 ) 385 Accounts payable, accrued liabilities, and other liabilities 4,810 1,847 Deferred revenue (5,259 ) (1,688 ) Operating lease liabilities (2,525 ) (2,673 ) Net cash provided by (used in) operating activities 18,086 (14,039 ) Cash flows from investing activities Proceeds from the sale and maturity of short-term investments 206,488 256,101 Purchase of short-term investments (50,197 ) (254,448 ) Acquisition of businesses, net of cash acquired (54,889 ) — Capitalization of internal-use software (9,858 ) (9,331 ) Purchase of intangible assets (504 ) (986 ) Purchases of property and equipment (1,203 ) (981 ) Proceeds from the sale of property and equipment 10 21 Net cash provided by (used in) investing activities 89,847 (9,624 ) Cash flows from financing activities Proceeds from issuance of long-term debt, net of issuance costs 115,472 — Payment of deferred financing costs (3,000 ) — Proceeds from employee stock purchase plan 2,061 3,206 Proceeds from exercise of stock options 169 937 Repurchase of common stock — (1,808 ) Repayment of seller-financed debt (646 ) — Net cash provided by financing activities 114,056 2,335 Effect of exchange rate changes on cash and cash equivalents 62 (13 ) Net increase (decrease) in cash and cash equivalents 222,051 (21,341 ) Cash and cash equivalents at beginning of period 106,276 116,312 Cash and cash equivalents at end of period $ 328,327 $ 94,971 Non-GAAP Financial Measures

To supplement our financial information presented in accordance with GAAP, we believe certain non-GAAP measures, including Adjusted Gross Profit, Adjusted Gross Margin, Adjusted EBITDA, Adjusted Net Income, and Adjusted Net Income per share, basic and diluted, are useful in evaluating our operating performance. For example, we exclude stock-based compensation expense because it is non-cash in nature and excluding this expense provides meaningful supplemental information regarding our operational performance and allows investors the ability to make more meaningful comparisons between our operating results and those of other companies. We use this non-GAAP financial information to evaluate our ongoing operations, as a component in determining employee bonus compensation, and for internal planning and forecasting purposes.

We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. A reconciliation is provided below for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, and not to rely on any single financial measure to evaluate our business.

Adjusted Gross Profit and Adjusted Gross Margin

Gross profit is a GAAP financial measure that is calculated as revenue less cost of revenue, including depreciation and amortization of capitalized software development costs and acquired technology. We calculate gross margin as gross profit divided by our revenue. Adjusted Gross Profit is a non-GAAP financial measure that we define as gross profit, adjusted for (i) depreciation and amortization, (ii) stock-based compensation, (iii) acquisition-related costs, net, and (iv) restructuring costs, as applicable. We define Adjusted Gross Margin as our Adjusted Gross Profit divided by our revenue. We believe Adjusted Gross Profit and Adjusted Gross Margin are useful to investors as they eliminate the impact of certain non-cash expenses, as well as certain other non-recurring operating expenses, and allow a direct comparison of these measures between periods without the impact of non-cash expenses and certain other non-recurring operating expenses.

We present both of these measures for our technology and professional services business. We believe these non-GAAP measures are useful in evaluating our operating performance compared to that of other companies in our industry, as these metrics generally eliminate the effects of certain items that may vary from company to company for reasons unrelated to overall profitability.

The following is a calculation of our gross profit and gross margin and a reconciliation of gross profit and gross margin to our Adjusted Gross Profit and Adjusted Gross Margin in total and for technology and professional services for the three months ended September 30, 2024 and 2023.

Three Months Ended September 30, 2024 (in thousands, except percentages) Technology Professional Services Total Revenue $ 48,653 $ 27,700 $ 76,353 Cost of revenue, excluding depreciation and amortization (17,609 ) (24,704 ) (42,313 ) Amortization of intangible assets, cost of revenue (3,741 ) — (3,741 ) Depreciation of property and equipment, cost of revenue (2,541 ) — (2,541 ) Gross profit 24,762 2,996 27,758 Gross margin 51 % 11 % 36 % Add: Amortization of intangible assets, cost of revenue 3,741 — 3,741 Depreciation of property and equipment, cost of revenue 2,541 — 2,541 Stock-based compensation 450 1,601 2,051 Acquisition-related costs, net(1) 77 121 198 Adjusted Gross Profit $ 31,571 $ 4,718 $ 36,289 Adjusted Gross Margin 65 % 17 % 48 % ___________________

(1) Acquisition-related costs, net include deferred retention expenses attributable to the Lumeon, Carevive, ARMUS, and KPI Ninja acquisitions.Three Months Ended September 30, 2023 (in thousands, except percentages) Technology Professional Services Total Revenue $ 45,973 $ 27,800 $ 73,773 Cost of revenue, excluding depreciation and amortization (15,169 ) (26,618 ) (41,787 ) Amortization of intangible assets, cost of revenue (4,390 ) — (4,390 ) Depreciation of property and equipment, cost of revenue (2,257 ) — (2,257 ) Gross profit 24,157 1,182 25,339 Gross margin 53 % 4 % 34 % Add: Amortization of intangible assets, cost of revenue 4,390 — 4,390 Depreciation of property and equipment, cost of revenue 2,257 — 2,257 Stock-based compensation 497 1,927 2,424 Acquisition-related costs, net(1) 66 96 162 Adjusted Gross Profit $ 31,367 $ 3,205 $ 34,572 Adjusted Gross Margin 68 % 12 % 47 % ___________________

(1) Acquisition-related costs, net include deferred retention expenses attributable to the ARMUS and KPI Ninja acquisitions.Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that we define as net loss adjusted for (i) interest and other (income) expense, net, (ii) income tax provision (benefit), (iii) depreciation and amortization, (iv) stock-based compensation, (v) acquisition-related costs, net, and (vi) litigation costs. We view acquisition-related expenses when applicable, such as transaction costs and changes in the fair value of contingent consideration liabilities that are directly related to business combinations, as costs that are unpredictable, dependent upon factors outside of our control, and are not necessarily reflective of operational performance during a period. We believe that excluding litigation costs allows for more meaningful comparisons between operating results from period to period as these are separate from the core activities that arise in the ordinary course of our business and are not part of our ongoing operations. We believe Adjusted EBITDA provides investors with useful information on period-to-period performance as evaluated by management and a comparison with our past financial performance, and is useful in evaluating our operating performance compared to that of other companies in our industry, as this metric generally eliminates the effects of certain items that may vary from company to company for reasons unrelated to overall operating performance. The following is a reconciliation of our net loss, the most directly comparable GAAP financial measure, to Adjusted EBITDA, for the three months ended September 30, 2024 and 2023:

Three Months Ended

September 30,2024 2023 (in thousands) Net loss $ (14,726 ) $ (22,032 ) Add: Interest and other (income) expense, net 1,514 (2,607 ) Income tax provision (benefit) (475 ) 59 Depreciation and amortization 9,983 10,190 Stock-based compensation 9,512 14,232 Acquisition-related costs, net(1) 1,487 2,126 Litigation costs(2) — 24 Adjusted EBITDA $ 7,295 $ 1,992 __________________

(1) Acquisition-related costs, net include third-party fees associated with due diligence, deferred retention expenses, post-acquisition restructuring costs incurred as part of business combinations, and changes in fair value of contingent consideration liabilities for potential earn-out payments.

(2) Litigation costs include costs related to litigation that are outside the ordinary course of our business. For additional details, refer to Note 15 in our condensed consolidated financial statements.Adjusted Net Income and Adjusted Net Income Per Share

Adjusted Net Income is a non-GAAP financial measure that we define as net loss adjusted for (i) stock-based compensation, (ii) amortization of acquired intangibles, (iii) acquisition-related costs, net, including the change in fair value of contingent consideration liabilities, (iv) litigation costs, (v) non-recurring lease-related charges, and (vi) non-cash interest expense related to debt facilities. We believe Adjusted Net Income provides investors with useful information on period-to-period performance as evaluated by management and comparison with our past financial performance and is useful in evaluating our operating performance compared to that of other companies in our industry, as this metric generally eliminates the effects of certain items that may vary from company to company for reasons unrelated to overall operating performance.

Three Months Ended

September 30,2024 2023 Numerator: (in thousands, except share and per share amounts) Net loss $ (14,726 ) $ (22,032 ) Add: Stock-based compensation 9,512 14,232 Amortization of acquired intangibles 6,839 7,063 Acquisition-related costs, net(1) 1,487 2,126 Litigation costs(2) — 24 Non-recurring lease-related charges(3) — — Non-cash interest expense related to debt facilities 1,319 378 Adjusted Net Income $ 4,431 $ 1,791 Denominator: Weighted-average shares outstanding used in calculating net loss per share, basic and diluted, and Adjusted Net Income per share, basic 60,440,694 56,710,602 Non-GAAP dilutive effect of stock-based awards 265,889 857,570 Non-GAAP weighted-average shares outstanding used in calculating Adjusted Net Income per share, diluted 60,706,583 57,568,172 Net loss per share, basic and diluted $ (0.24 ) $ (0.39 ) Adjusted Net Income per share, basic $ 0.07 $ 0.03 Adjusted Net Income per share, diluted $ 0.07 $ 0.03 ______________

(1) Acquisition-related costs, net includes third-party fees associated with due diligence, deferred retention expenses, post-acquisition restructuring costs incurred as part of business combinations, and changes in fair value of contingent consideration liabilities for potential earn-out payments.

(2) Litigation costs include costs related to litigation that are outside the ordinary course of our business. For additional details, refer to Note 15 in our condensed consolidated financial statements.

(3) Non-recurring lease-related charges include the lease-related impairment charge related to our corporate office space designated for subleasing. For additional details, refer to Note 9 in our condensed consolidated financial statements.Health Catalyst Investor Relations Contact:

Jack Knight

Vice President, Investor Relations

+1 (855)-309-6800

ir@healthcatalyst.comHealth Catalyst Media Contact:

Amanda Flanders

SVP, Marketing and Communications

media@healthcatalyst.com

To view this slide as a PDF, please click here: http://ml.globenewswire.com/Resource/Download/9bfc698a-cc88-45a1-a884-6d7327527522